OUR PRODUCTS

General Accident Insurance

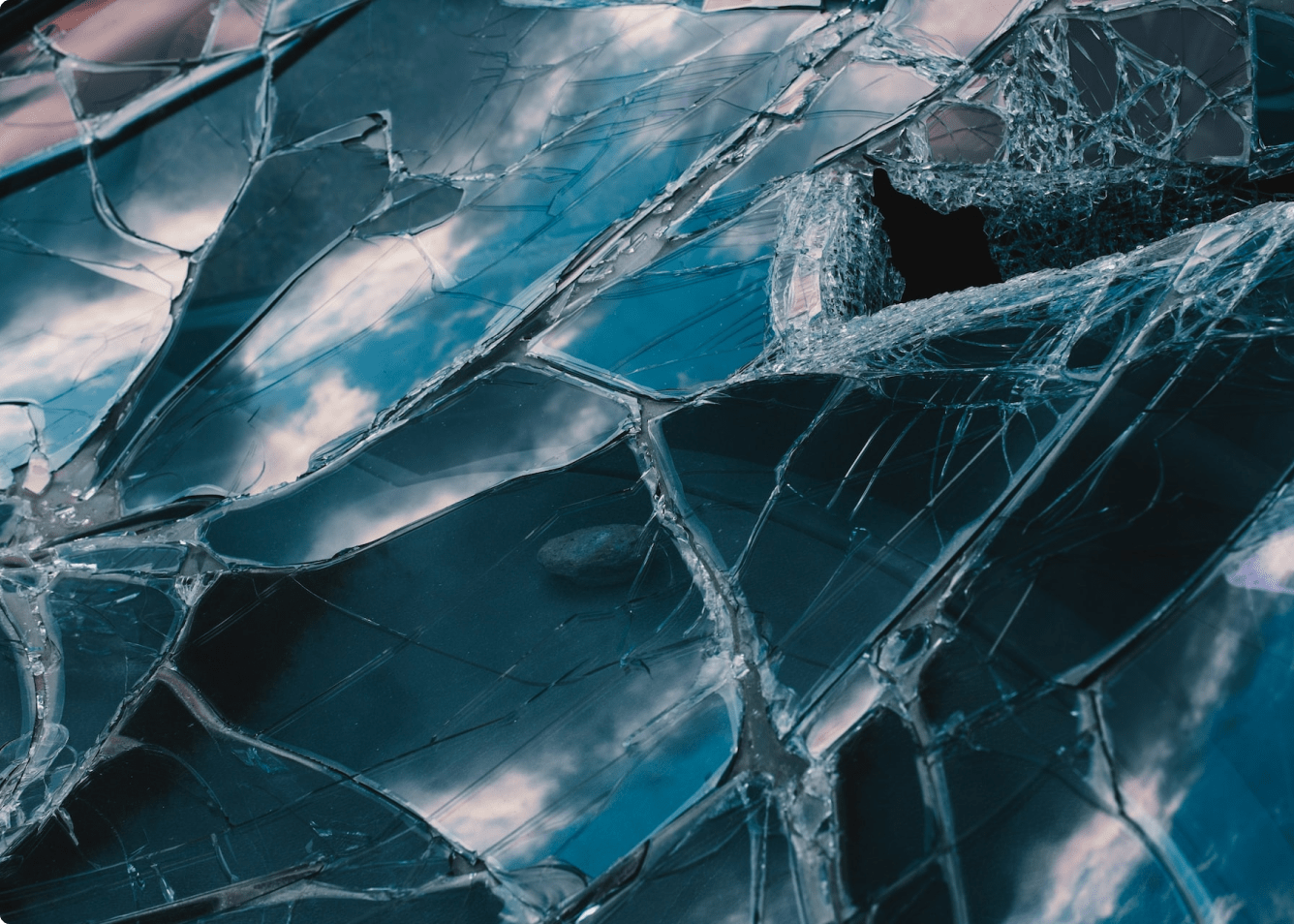

Housebreaking/Burglary Insurance

It provides indemnity for loss of or damage to properties

resulting from theft or attempt thereat following visible and

violent entry or exit from the premises.

It also covers damage to building or property in the bid to

effect entry or exit in connection with burglary or theft.

Group Personal Accident Insurance

This policy provides cover for bodily injury (permanent or

temporary) caused solely and directly by accidental, violent

and visible means on 24 hours basis anywhere in the world.

Compensation is equally provided where such accident

results in death or hospitalization.

Employers’ Liability/ Workmen’s Compensation Insurance

Under the Workmen’s Compensation (Decree 17, 1987) all

employees of a company are deemed covered irrespective

of position, and medical expenses are unlimited. The

workmen compensation covers the employees only during

working hours against Death, P.T.D., T.T.D and unlimited

Medical Expenses (but subject to expenses incurred being

reasonable with underwriter’s prior consent).

Product Liability Insurance

Product Liability Insurance is a form of general liability

insurance meant to protect the insured from financial and

legal consequences as a result of bodily injury or property

damage due to the use of their business’s sold goods or

products. It covers the legal and court costs of defending

any claims of bodily injury, property damage, or financial

losses caused by the insured’s product.

Public Liability

A General Public Liability policy protects the insured in

respect of his Legal Liability to Third Parties for both bodily

injury, death and for any loss or damage to property.

Professional Indemnity Insurance

that may arise by reason of any neglect, error or omission

committed in a professional capacity by the person insured

or by any partner, director, persons who may be in his

employment. The policy also takes care of all costs, charges and expenses required to contest the case and all other

expenses made with the consent of the Insurers.

Fidelity Guarantee Insurance

This is the only policy that provides Compensation to an

employer against the dishonest acts of his employees for

money or stock, e.g. Cashiers, Accountants, Store

Keepers, Stock brokers, Salesmen and so on.

Occupiers Liability Insurance

This policy protects the owner or occupier of the building

against legal liabilities for bodily injury, death and

loss/damage of property suffered by any user of the

premises and third parties, as a result of fire, collapse,

storm, earthquake, storm, flood or any allied peril.

It also covers legal costs which are recoverable from the

insured by claimants, and costs and expenses incurred by

the insured.

General Third-Party Liability Insurance

This is a policy that provides cover against your legal

liability to pay compensation for injury or damage to

property caused to a third party in connection to your

business. For example, if a customer slips and trips while

on your business premises.

Directors and Officers Liability Insurance

This is a policy that provides cover for the personal assets

of corporate directors and officers, and their spouses, in the

event they are personally sued by employees, vendors,

competitors, investors, customers, or other parties, for

actual or alleged wrongful acts in managing a company.

Money Insurance

Cash-In-Transit policy provides compensation for loss of

money belonging to the insured or for which the insured is

responsible, occurring;

1. whilst in Transit from or to the bank.

2. whilst in the safe – the safe maybe broken into and the

cash stolen.

3. whilst in personal custody or possession of responsible

officials like cashiers, Accountant or Managing Director.

4. damage to the safe.

All Risks

This policy provides protection for items and personal

belongings that are of high value in nature and movable like

Jewelries, Paintings, Cameras, Laptops, Computers, Wrist

Watches etc.

It provides protection beyond the normal scope of Fire and

Burglary as loss arising from accidents, larceny, infidelity

and cover extends while the property insured is in transit

and from one place to another, and whilst temporarily

housed.

All Risk cover is a worldwide cover as any loss /damage to

the insured item anywhere around the world is covered

unless it is specifically restricted to a particular

geographical location. All Risk does not mean that all

losses are covered as there are specific exclusions in the

policy.

Building Under Construction

Section 64 of Insurance Act 2003 stipulates that for

buildings under construction, every owner or contractor of

any building under construction with more than two floors

must take an insurance policy to cover liability against

construction risks caused by his negligence or that of his

servants, agents or consultants which may result in death,

bodily injury or property damage to workers on site or

members of the public.

This insurance policy also covers liability for collapse of

buildings under construction.

Goods-in-Transit Insurance

This product provides for loss or damage to goods whilst in

Transit or during loading or unloading under two types of cover.

a) Restricted Cover Fire, Accidental Damage caused by collision or overturning of the carrying vehicle(s) Theft by violence or any attempt thereat.

b) All Risks Cover Covering the properties independent of whatever happens to the conveying vehicle.